College Money Matters Apr 2025 Newsletter

April 27, 2025

College Money Matters August 2025 Newsletter

August 20, 2025College Money Matters March 2025 Newsletter

In this edition:

Try the new loan cost estimators from College Money Matters

- Calculator 1: How much will your loan cost you?

- Calculator 2: How your monthly payments affect how much you can borrow

- Calculator 3: How will a Parent PLUS Loan fit into your family budget?

Other resources:

Thinking of getting a student loan? Do the math first.

If you’re looking at colleges where the price would require you to take out a loan, it’s important to know how much that loan could cost you.

After all, whenever you borrow money, you have to pay interest on it. And the longer it takes to pay your loan back, the more interest you pay. What’s more, that interest portion doesn’t go to your college. It’s just money that goes to whoever provides the loan -- money you could be using for other things.

That’s why we suggest figuring out your potential costs before you decide to take out a student loan. And we’ve designed some new tools to help you do just that.

Try the new loan cost estimators from College Money Matters

Use the links shown here, and you’ll have a quick and easy way to see what different loan amounts could cost you to pay back, using today’s interest rates. These calculators use a payback time of 10 years after graduation, which is the payback time most students choose.

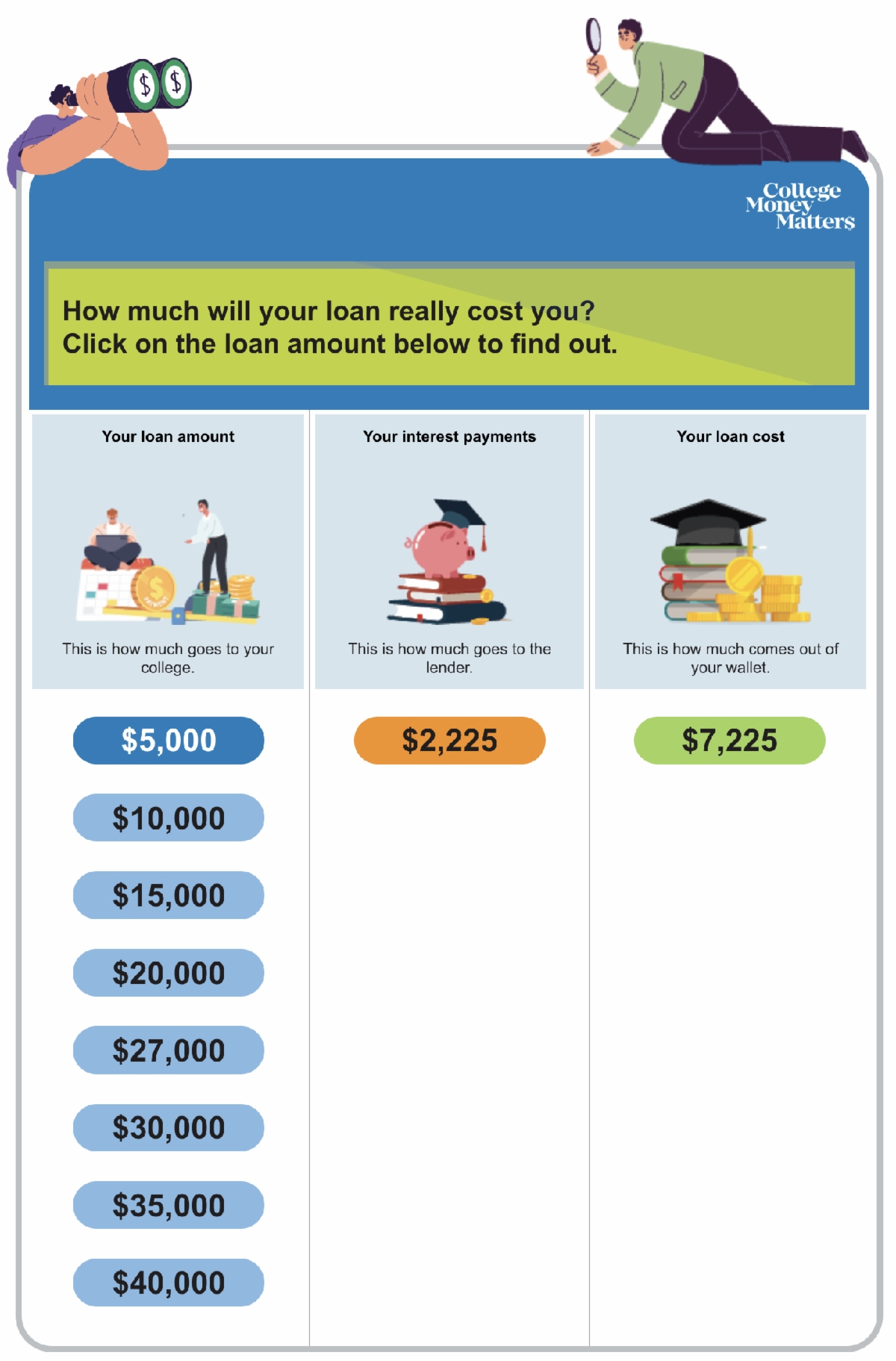

Calculator 1: How much will your loan really cost you?

Use this link to find out what happens when you take out student loans of different amounts. You’ll see:

• The loan amount that goes to your education

• The additional amount you pay to the lender in interest

• How those two amounts add up to your total loan cost

Note: Interest calculations reflect the current 6.53% rate for Federal Student Loans, up to the maximum $27,000 for 4 years. Any amounts over $27,000 are calculated at a representative private lender rate of 10%. Interest rates are subject to change.

Calculator 2: How your monthly payments affect how much you can borrow

This link lets you look at student loans from the viewpoint of how much you can afford in monthly payments. You’ll learn:

• How much of a loan you might get with a certain monthly payment

• Your total loan cost - How much of your monthly payment goes to interest and how much goes to your college

• The amount that actually goes to your college to help pay for your education

Note: Interest calculations reflect the current 6.53% rate for Federal Student Loans, up to the maximum $27,000 for 4 years. Any amounts over $27,000 are calculated at a representative private lender rate of 10%. Interest rates are subject to change.

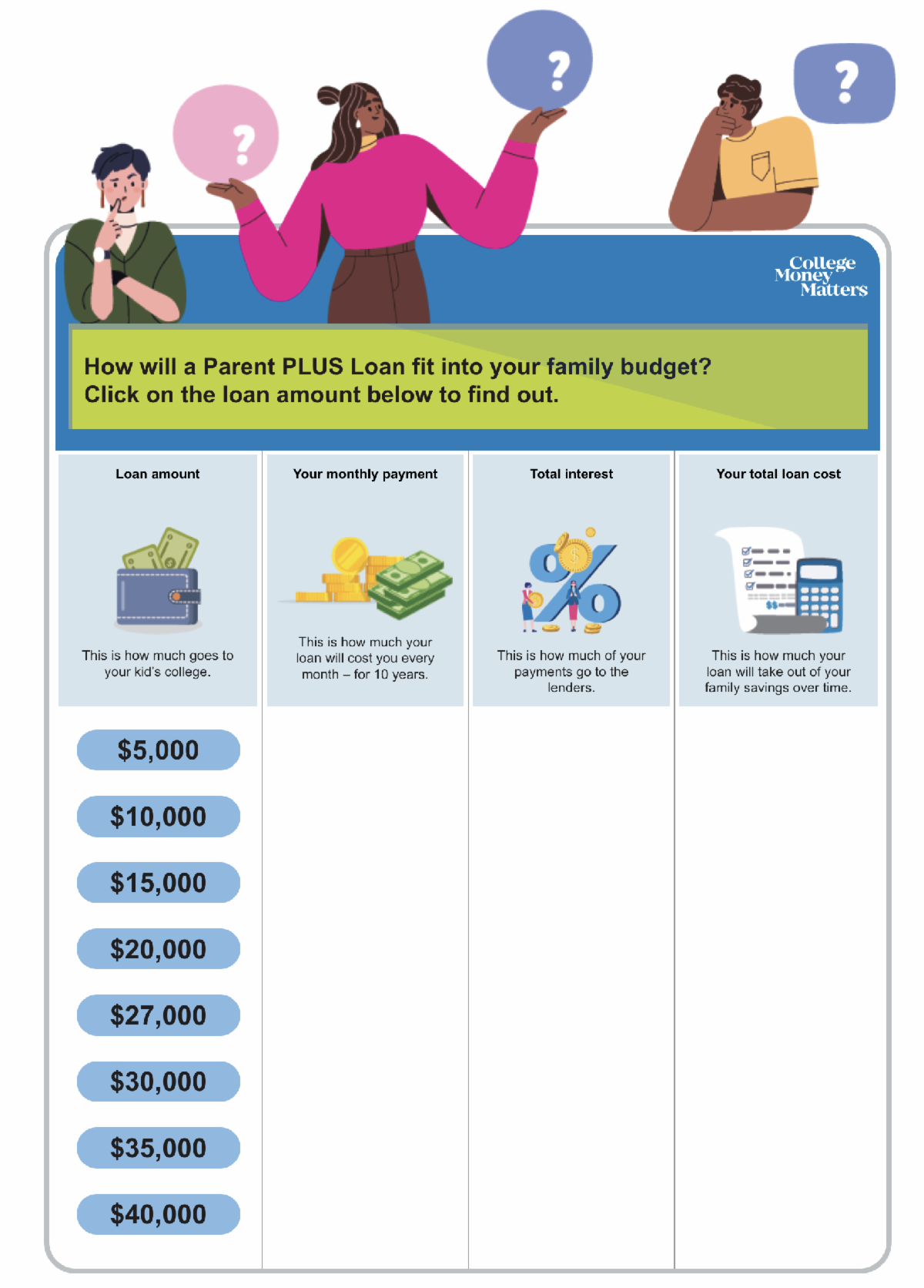

Calculator 3: How will a Parent PLUS Loan fit into your family budget?

This link provides a calculator for parents looking to support their child’s college education with a Parent PLUS Loan.

Parent PLUS loans are loans that the US government makes to parents of college students, provided their credit history Is acceptable. However, their interest rates tend to be relatively high compared to some other college loans – and the government doesn’t set limits that could prevent parents from borrowing more than they should.

The calculator shows:

• The loan amount that goes to the student’s education

• The monthly payment it will take to pay back that amount over 10 years

• The additional amount paid to the lender in interest (Notice that this is more than half the amount that goes to the student’s college.)

• The total cost of the loan

To learn more about Parent PLUS loans, visit this page on the College Money Matters website: Parent PLUS college loans: How much is too much love?

Note: Interest calculations reflect the current 9.08% rate for Parent PLUS loans. Note: Interest rates are subject to change.

Enter specific amounts with this loan calculator

This student loan calculator, available on calculator.net, lets you estimate what your monthly student loan payments will be, based on any loan amount you enter. The big thing to remember here is that while the calculator estimates what one year in college could cost in loans, it takes four years to graduate, so you need to multiply those costs by four. Plus, interest rates change every year. But remember, each year that you're in college can mean another loan – and a different interest rate, too. So do the math for one year and four years.

Detailed Student Loan Calculator

This link takes you to a calculator on FinAid.org, a site run by recognized FAFSA expert, Mark Kantrowitz. Please note: the information you provide on the FinAid site may be used for marketing purposes.

We hope you find these calculators and estimators helpful. And one other thing: While you’re looking at the numbers, think about whether you can get a quality education at a lower-priced school – one that might not require you to take out a loan at all, or at least a smaller amount in loans.